You can also mandate that all petty cash transactions be under a certain dollar amount, like $25. Revenues and gains are recorded in accounts such as Sales, Service Revenues, Interest Revenues (or Interest Income), and Gain on Sale of Assets. These accounts normally have credit balances that are increased with a credit entry. We now offer eight Certificates of Achievement for Introductory Accounting and Bookkeeping. The certificates include Debits and Credits, Adjusting Entries, Financial Statements, Balance Sheet, Income Statement, Cash Flow Statement, Working Capital and Liquidity, and Payroll Accounting.

المحتوي

Do you already work with a financial advisor?

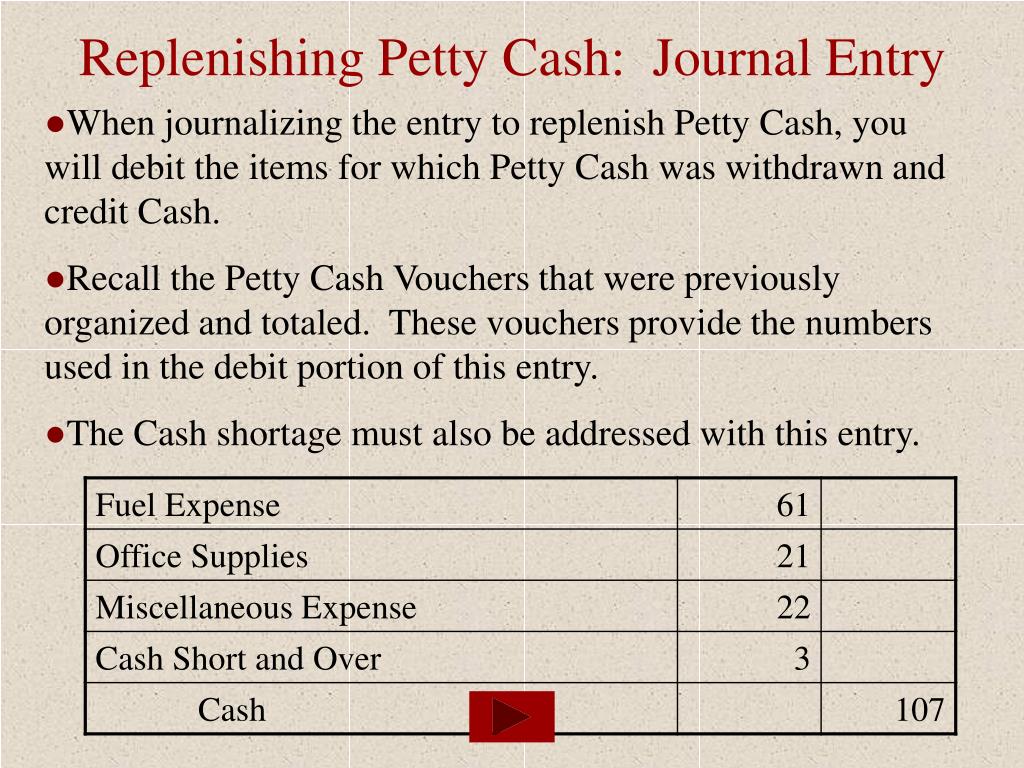

Only when the fund is reimbursed, or when the end of the accounting period arrives, does the firm make an entry in the journal. Properly tracking petty expenses and ensuring you the petty cash account cash short and over is a permanent account. have a healthy, accurate cash balance isn’t so bad when you follow the tips above. If every employee has access to petty cash, bad or nonexistent record keeping usually results.

The cash over and short account

Furthermore, keep a Microsoft Excel doc or other spreadsheets that tracks who spent what, when it was spent, and the total amount of spending for both the month and year to date. Not only will this help you hold employees accountable, it will also ensure you’re more prepared at tax time. Petty cash is often used to make change for customers and pay for small, erratic expenses that pop up. These expenses could be things like office supplies, a small repair, and so on.

إقرأ أيضا:Online Casino instadebit Bewertung Spielsaal durch Handyrechnung retournierenExamples of Post-Closing Entries in Accounting

In his article for the Institute of Internal Auditors, bank auditor Umair Danka notes that there’s a significant risk of petty cash being spent on non-business activities. To combat this, make sure your employees understand upfront what petty cash can and can’t be spent on. Keeping a small amount of cash in your office or at your store makes it much easier for office managers, bookkeepers, and supervisors to cover occasional small purchases or expenses. Accruing tax liabilities in accounting involves recognizing and recording taxes that a company owes but has not yet paid. It’s an “other expense” for you, not a normal expense like paying your bills.

- Accruing tax liabilities in accounting involves recognizing and recording taxes that a company owes but has not yet paid.

- The journal entry for giving the custodian more cash is a debit to the petty cash fund and a credit to cash.

- Take self-paced courses to master the fundamentals of finance and connect with like-minded individuals.

- A petty cash fund is a small amount of company cash, often kept on hand (e.g., in a locked drawer or box), to pay for minor or incidental expenses, such as office supplies or employee reimbursements.

- For example, the Galaxy’s Best Yogurt maintains a petty cash box with a stated balance of $75 at all times.

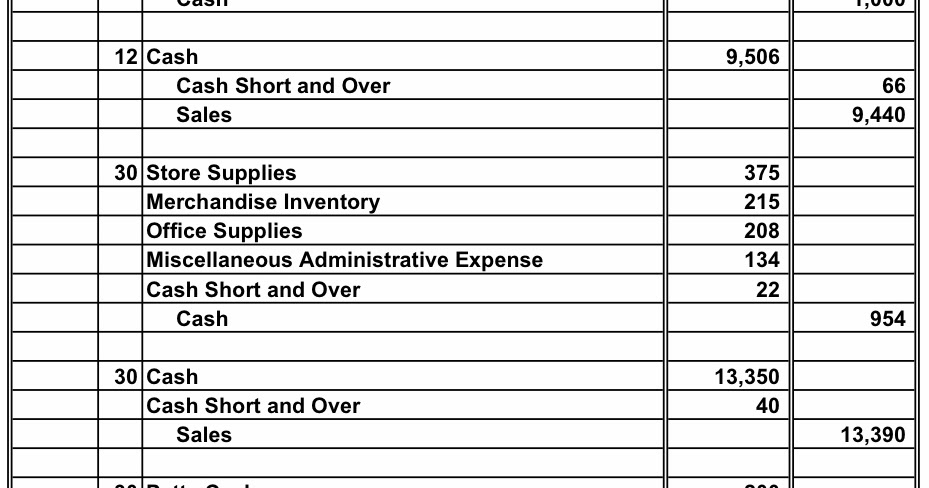

Here, you create a new journal entry in your accounting journal and debit, or increase, each expense account by the amount of cash used by your vouchers. In the example, debit the office supplies expense account for $300, and debit the transportation expense account for $140. For example, on December 22, after reconciling the cash on hand with the cash sales, we find that there is a cash shortage of $5. The total amount of cash sales in the sales receipts is $2,790, however, the actual cash we have is only $2,785 (excluding the $100 cash prepared for small notes changes at the beginning of the day). This is probably due to there have been many transactions for our retail business as it is near holiday resulting in errors in our calculation. In order to properly account for petty cash expenditures, they should be recorded in the general ledger.

إقرأ أيضا:Finest Online casinos United states of america Their Guide to Safe Gambling establishment Sites 2025Petty cash funds

But it can be helpful to keep paper slips too, along with receipts from the purchases or payments (if possible). In the financial world, it also refers to a company’s highly liquid assets—funds in checking or other bank accounts, money market funds, short-term debt instruments, or other cash equivalents. Though not literally cash, it’s money that can be easily and quickly accessed, which is why it’s “on hand.” In fundamental accounting, debits are balanced by credits, which operate in the exact opposite direction. As noted earlier, expenses are almost always debited, so we debit Wages Expense, increasing its account balance. Since your company did not yet pay its employees, the Cash account is not credited, instead, the credit is recorded in the liability account Wages Payable.

إقرأ أيضا:Wafer Erreichbar Casinos präsentation 50 Freispiele triple chance Slot -Wettstrategien exklusive Einzahlung aktiv?The petty cashier should hand out these vouchers whenever an employee requires funds for a small expense. Note that the entry to record replenishing the fund does not credit the Petty Cash account. In this case, the cash needed to get back to $100 ($100 fund – $7.40 petty cash on hand) of $92.60 equals the total of the petty cash vouchers. In accounting, cash over and short journal entry is usually made when the company replenishes its petty cash fund. This is due to the cash remaining and the receipts in the petty cash box may not equal the amount of petty cash fund established. Require that employees maintain a running petty cash log for every transaction, including receipts.

The total amount of purchases from the receipts ($45), plus the remaining cash in the box should total $75. As the receipts are reviewed, the box must be replenished for what was spent during the month. To permit these cash disbursements and still maintain adequate control over cash, companies frequently establish a petty cash fund of a round figure such as $100 or $500.