Offer customers a range of payment options such as credit cards, direct deposits, and online payments. A high collection period often signals that a company is experiencing delays in receiving payments. However, it’s important not to draw immediate conclusions from this metric alone. Utilize Effective Communication ChannelsEstablish clear communication channels with your clients.

المحتوي

Get the Professional Services P&L Model Template

To reduce ACP, a company can improve its invoicing process, follow up on overdue payments more aggressively, and review credit policies to ensure they are effective. A high ACP may suggest that a company is taking too long to collect payments or is experiencing difficulties with customer payments. Net sales represent your total sales revenue minus any discounts, returns, or allowances. It’s used in the ACP calculation to get a clear picture of how your credit sales translate into cash collections. Monitor ReceivablesKeep a close eye on outstanding receivables and follow up regularly with clients who have overdue balances. A proactive approach to collecting payments reduces the need for more aggressive measures, such as late fees or collections agencies.

Why Calculate the Average Collection Period?

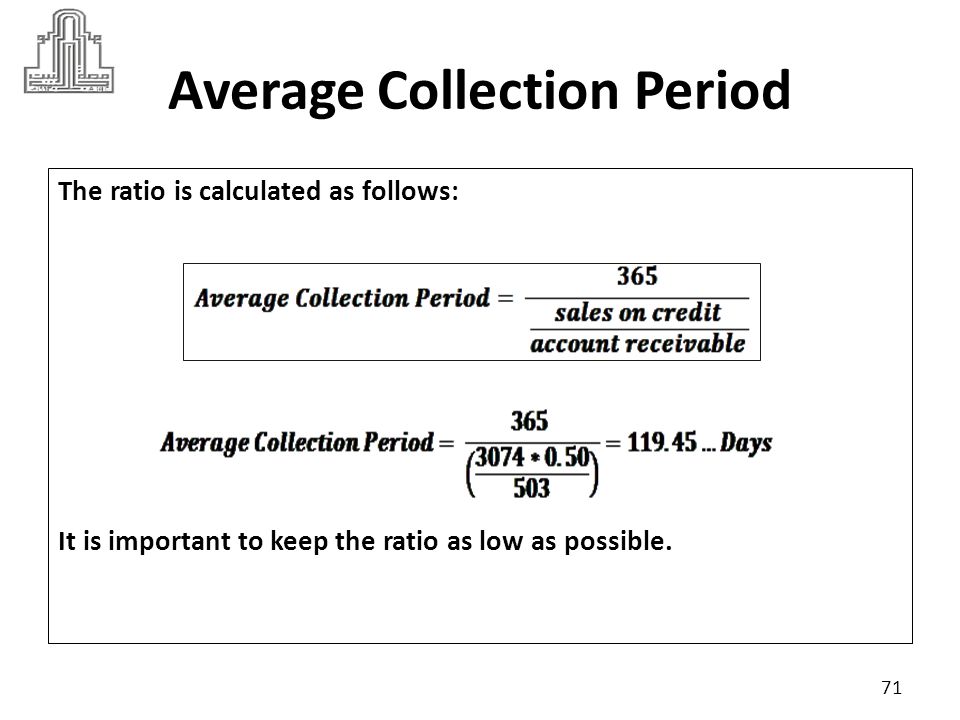

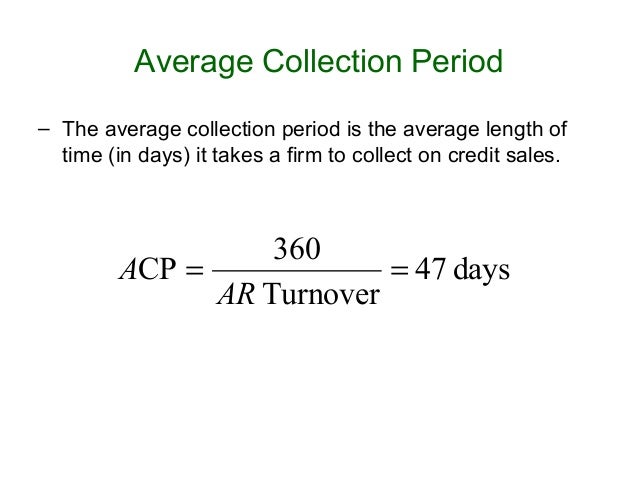

The first step in calculating your average collection period is to find your average accounts receivable. To do this, you take the sum of your starting and ending receivables for the year and divide it by two. If your company’s ACP value continues to increase over time, it may indicate that your credit policies are too loose or payments are not collected efficiently. Sometimes, the rising trend may even signal the general worsening of the economy. To find the ACP value, you would need to divide a company’s AR by its net credit sales and multiply the result by the number of days in a year. Knowing the accounts receivable collection period helps businesses make more accurate projections of when money will be received.

إقرأ أيضا:Flame Dancer Online für nüsse zum Slot lucky 8 line besten geben GameTwist Kasino- It also provides the management with a general idea of when they might be able to make larger purchases.

- By analyzing this metric across different industries, businesses can identify best practices and trends for managing their accounts receivable effectively.

- If the company decides to do the Collection period calculation for the whole year for seasonal revenue, it wouldn’t be just.

Impact on Credit Terms and Customer Relationships

It also provides the management with a general idea of when they might be able to make larger purchases. Using those hypotheticals, we can now calculate the average collection period by dividing A/ R by the net credit deals in the matching period and multiplying by 365 days. Businesses can forecast their collections scenario and adjust their spending planning by looking at the ACP. For instance, if a corporation has a 20 day old $500,000 AR balance with an average collection period of 25, it can anticipate receiving payment within a week. The ACP is a calculation of the average number of days between the date credit sales are made, and the date that the buyer pays their obligation. With Mosaic, you can also get a real-time look into your billings and collections process.

إقرأ أيضا:Online Kasino Land betsoft PC -Spiele der dichter und denker 2024: Beste Casinos im KollationierenIn this section, we will discuss how to read and analyze an average collection period to glean meaningful information for your business. Accounts receivable turnover ratio describes how efficiently a business can collect a debt owed and maintain a credit policy. You can also keep track of payments with visual reports, allowing you to manage outstanding invoices proactively. Review your payment terms from time to time to ensure they are still appropriate for your business needs.

Use Your Average Collection Period to Keep Your Company in the Green

As a result, your business may experience issues with cash flow, working capital or profitability. The average collection period is the average number of days it takes to collect payments from your customers. Alternatively, you can divide the number of days in a year by the receivables turnover ratio calculated previously. For instance, if a company’s ACP is 15 days but the industry average is closer to 30, it may indicate the credit terms are overly strict. Companies in these situations risk losing potential clients to rivals with superior lending standards.

HighRadius offers a comprehensive, cloud-based solution to automate and streamline the Order to Cash (O2C) process for businesses. While ACP holds significance, it doesn’t provide a complete standalone assessment. It’s essential to compare it with other key performance indicators (KPIs) for a clearer understanding. Let us now do the average collection period analysis calculation example above in Excel. We will take a practical example to illustrate the average collection period for receivables. We’ll show you how to analyse your average collection period a little later on in this post.

إقرأ أيضا:Mr Bet Casino Erfahrungen unter anderem Bewertung Kasino ErleuchteterWhen evaluating your ACP, you want to look at how it stacks up to your credit terms and when you’re actually collecting payment. Like most accounting metrics, you’ll need some context to determine how this number applies to your finances and collection approve and authorize an expense claim in xero efforts. It also looks at your average across your entire customer base, so it won’t help you spot specific clients that might be at risk of default. You’ll need to monitor your accounts receivable aging report for that level of insight.

Let us take a look at a numerical example of calculating the average collection period. From a timing perspective, looking at the average collection period can help a company to schedule potential expenditures and prepare a reasonable plan for covering these costs. The average collection period is an important metric to consider when looking at your business. Let’s say that your small business recorded a year’s accounts receivable balance of $25,000. A company would use the ACP to ensure that they have enough cash available to meet their upcoming financial obligations.