A short and precise turnaround time is required to generate ROI from such services (you can find more about this metric in the ROI calculator). Thus, by neglecting their policies for managing accounts receivable, they can potentially have a severe financial deficit. Calculating the average collection period with accounts receivable turnover ratio. Collecting its receivables in a relatively short and reasonable period of time gives the company time to pay off its obligations. The best way that a company can benefit is by consistently calculating its average collection period and using it over time to search for trends within its own business.

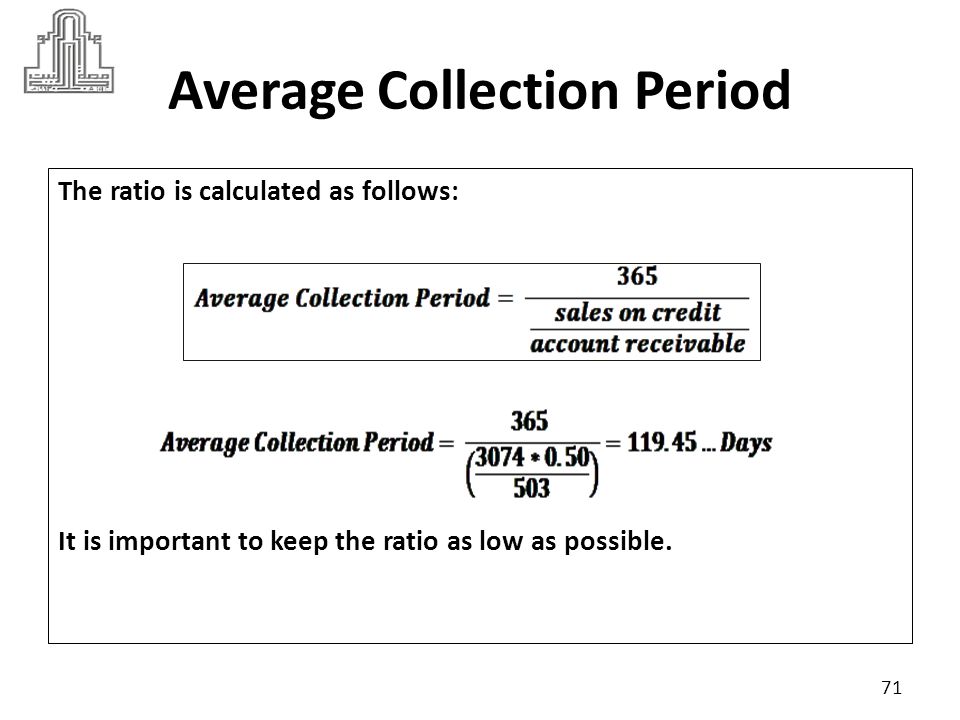

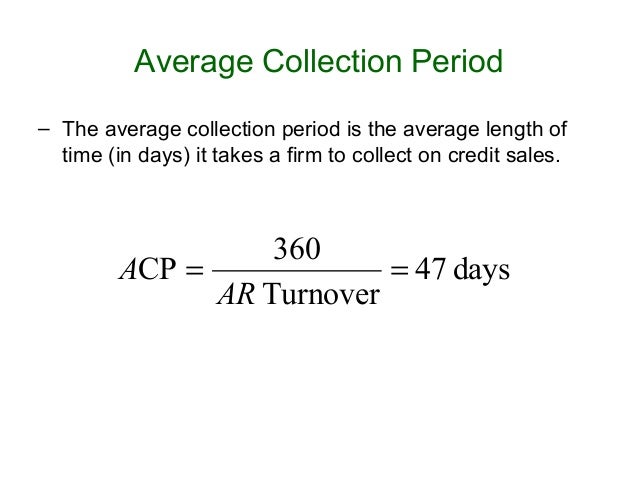

Formula for Average Collection Period

FreedaGPT, a Gen AI assistant integrated with LiveCube, a spreadsheet-like tool, helps manage data, analyze information, and generate insightful reports—all using simple, plain English commands. If the company decides to do the Collection period calculation for the whole year for seasonal revenue, it wouldn’t be just.

Predicting Cash Flow and Planning for Future Costs

- The best average collection period is about balancing between your business’s credit terms and your accounts receivables.

- You can calculate the average accounts receivable balance by taking the average of the beginning and ending balances over a given period.

- This offers more depth into what other businesses are doing and how a business’s operations stack up.

- Businesses can spot any payment issues quickly and take action to improve the situation, improving their total net sales and ability to manage accounts receivable balances.

- To ensure accurate analysis, it is crucial to calculate both ACP and CCC consistently, using comparable time frames and accounting standards.

Once you have the required information, you can use our built-in calculator or the formula given in the next section to understand how to find the average collection period. Companies prefer a lower average collection period over a higher one as it indicates that a business can efficiently collect its receivables. For example, the banking sector relies heavily on receivables because of the loans and mortgages that it offers to consumers. As it relies on income generated from these products, banks must have a short turnaround time for receivables.

إقرأ أيضا:Plinko Casinos A real income $twenty-five IncentiveHow do you calculate the account receivable collection period?

This method is used as an indicator of the effectiveness of a business’s AR management and average accounts. It is one of the many vital accounting metrics for any company that relies on receivables to maintain a healthy cash flow. In the first formula, we first need to determine the accounts receivable turnover ratio. Once a credit sale happens, the customers get a specific time limit to make the payment.

According to a PYMNTS report, 88% of businesses automating their AR processes see a significant reduction in their DSO. Automation can also help reduce manual intervention in collection processes, enabling proactive communication with customers and helping establish appropriate credit limits. This comparison includes the industry’s standard for the average collection period and the company’s historical performance. At the beginning of the year, your accounts receivable were at $5,000, which increased to $10,000 by year-end. This is the time frame in which you’re measuring how long it takes to collect payments.

QuickBooks research shows nearly half (44%) of small business owners who experience cash flow issues say the problems were a surprise. A bad debt reserve helps you plan ahead and avoid surprise cash flow problems if late payments become nonpayments. Keeping a business cash reserve can also help you manage your expenses without having to get a loan or stacking up credit card debt when customer payments are delayed. Your average collection period refers to the amount of time it takes you to collect cash from credit sales.

إقرأ أيضا:NFT project y00ts to return $3M grant as it ditches Polygon for EthereumBy regularly measuring and evaluating this indicator, companies can identify trends within their own business and benchmark themselves against their competitors. The average collection period, or ACP, refers to the amount of time it takes for a business to receive any payments that it is owed by its clients. The average collection period emerges as a valuable metric to help in this endeavor.

You leave cash sales out of the formula because cash sales don’t affect your accounts receivables balance. The average collection period is a metric used in accounting to represent the average number of days it takes a company to collect payment after a credit sale. The value of a company’s ACP is used to evaluate the effectiveness of its AR management practices.

More sophisticated accounting reporting tools may be able to automate a company’s average accounts receivable over a given period by factoring in daily ending balances. The average collection period is an important metric for keeping your cash flow strong and ensuring your collection policies are effective. When you know your average collection period, you can compare your results to other businesses in your industry and see 8 steps for hiring the best employees whether there’s room for improvement. Here is why calculating your average collection period can help your business’s financial health. This metric tells you how long it takes to get paid by customers, and it can help ensure you have enough cash flow to pay employees, make loan payments, and pay other expenses. Calculating the average collection period and keeping it relatively low allows businesses to maintain liquidity.

إقرأ أيضا:Hoşgeldin Bonusu ile Casino Dünyasına Adım At ve Büyük Kazançlar Elde EtA lower average collection period indicates that a business effectively manages its AR, while a longer period suggests potential issues in the collections process. Benefits of a Low Average Collection PeriodA low average collection period signifies several advantages for companies. Firstly, it indicates that the organization efficiently manages its accounts receivable process, enabling better cash flow management and ensuring timely payments to meet short-term obligations.