Thus, when accounts receivable increases, sales revenue on a cash basis decreases (some customers who bought merchandise have not yet paid for it). When inventory increases, cost of goods sold on a cash basis increases (increasing cash outflow). When a prepaid expense increases, the related operating expense on a cash basis increases. (For example, a company not only paid for insurance expense but also paid cash to increase prepaid insurance.) The effect on cash flows is just the opposite for decreases in these other current assets. The purpose of our cash flow is to reconcile cash so we will use the figure later. Alternatively, the indirect method starts with profit before tax rather than a cash receipt.

المحتوي

Computing cash flows

The direct method is intuitive as it means the statement of cash flow starts with the source of operating cash flows. The operating cash outflows are payments for wages, to suppliers and for other operating expenses which are deducted. If not too lengthy, these items can be disclosed in the notes or at the bottom of the statement. The cash received for dividend income and interest income was taken directly from the income statement since no accrual accounts exist on the balance sheet for these items. Cash paid for interest charges and income taxes are calculated on the basis of an analysis of their respective liability accounts from the balance sheet and expense accounts from the income statement. The most common example of an operating expense that does not affect cash is depreciation expense.

إقرأ أيضا:‘No fucking way’ — Joe Rogan, Post Malone slam US government CBDCRelated AccountingTools Courses

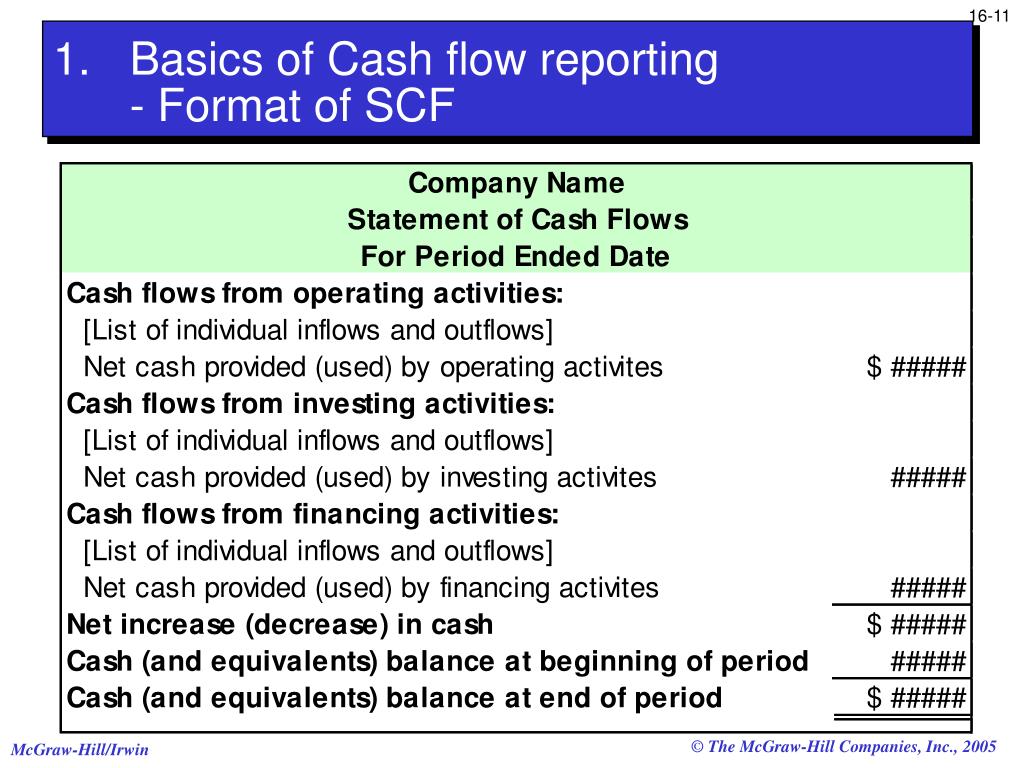

Only then are the two actual cash flows of interest paid and tax paid presented. Having a good understanding of the format of the statement of cash flows is key to a successful attempt at these questions. Investing activities cash flows are those that relate to non-current assets, including investments. Examples of cash flows from investing activities include the cash outflow on buying PPE, the sale proceeds on the disposal of non-current assets and any cash returns received arising from investments. As noted above, IAS 7 permits two different ways of reporting cash flows from operating activities – the direct method and the indirect method.

AccountingTools

This method converts each item on the income statement directly to a cash basis. Alternatively, the indirect method starts with accrual basis net income and indirectly adjusts net income for items that affected reported net income but did not involve cash. As a general rule, an increase in a current asset (other than cash) decreases cash inflow or increases cash outflow.

As illustrated above, when using the indirect method, the sum of the non-cash adjustments to net income and changes to non-cash working capital accounts result in the total cash flows in (out) from operating activities. Any non-cash transactions occurring in the investing or financing sections are not reported in a statement of cash flows. Instead, they are disclosed separately in the notes to the financial statements. Examples of non-cash transactions would be an exchange of property, plant, or equipment for common shares, or the conversion of convertible bonds payable to common shares and stock dividends. If the transaction is a mix of cash and non-cash, the cash-related portion of the transaction is reported in the statement of cash flows with a note in financial statements detailing the non-cash and cash elements. The final section of the statement reconciles the net change in cash flows of the three activities, with the opening and closing cash and cash equivalents balances taken from the balance sheet.

إقرأ أيضا:Taiwan officials launch inquiry into crypto betting on election results: ReportClassification of cash flows

EXAMPLE 3 – Calculating the dividend paidAt 1 January 20X1, Crombie Co had retained earnings of $5,000. Profit for the year was $4,500 and retained earnings at 31 December 20X1 are $7,000. The following example illustrates both the direct and indirect methods. The sale of the patent is straightforward since there were no other sales, purchases, or amortization in the current year (as stated in steps 2 and 4).

The profit before tax is then reconciled to the cash that it has generated. This means that the figures at the start of the cash flow statement are not cash flows at all. In that initial reconciliation, the profit before tax is adjusted for income and expenses that have been recorded the reporting of investing activities is identical under the direct method and indirect method. in the statement of profit or loss but are not cash inflows or outflows. For example, depreciation and losses on disposal of non-current assets, have to be added back, and non-cash income such as investment income and profits on disposal of non-current assets are deducted.

PwC refers to the US member firm or one of its subsidiaries or affiliates, and may sometimes refer to the PwC network. This content is for general information purposes only, and should not be used as a substitute for consultation with professional advisors.

إقرأ أيضا:ملف قنوات سيناتور 999 بلوتوث Senator 999 Bluetooth WiFi الذهبىFor example, an increase in the levels of inventory and receivables will not impact profit before tax but will have had an adverse impact on the cash flow of the business. Therefore, in the reconciliation process, the increases in inventory and trade receivables are deducted from profit before tax. Conversely, decreases in inventory and trade receivables are added back to the profit before tax. The three activities total a net increase in cash of $57,500.

- This rate of return is known as the discounted rate, which is essentially the interest rate, discounted over some time.

- The statement of cash flows above for Wellbourn Services Ltd. is an example of a statement using the direct method.

- Financing activities cash flows relate to cash flows arising from the way the entity is financed.

- Examples of non-cash transactions would be an exchange of property, plant, or equipment for common shares, or the conversion of convertible bonds payable to common shares and stock dividends.

- For example, the opening balance of $325,000 above is the sum of the current portion ($45,000) plus the long-term portion ($280,000).

Solution Here we can take the opening balance of PPE and reconcile it to the closing balance by adjusting it for the changes that have arisen in the period that are not cash flows. Solution It is necessary to reconcile the opening tax liability to the closing tax liability to reveal the cash flow – the tax paid – as the balancing figure. Note that the interest income of $2,000 reported in the income statement is not included in the additional disclosures shown above. This is because the interest income was accrued as an adjusting entry regarding the trading investments, so it was not a cash-received item.

For the past 52 years, Harold Averkamp (CPA, MBA) hasworked as an accounting supervisor, manager, consultant, university instructor, and innovator in teaching accounting online. He is the sole author of all the materials on AccountingCoach.com. Under the U.S. reporting rules, a corporation has the option of using either the direct or the indirect method.